Omar Everleny Pérez Villanueva

The (Temporary?) Role of MLC in the Cuban Economy

Cuba’s difficult financial situation is no secret to anyone, especially in these last five years. But it is also the result of structural issues that have weighed on the economy since a fairly long time ago. Multiple factors affect the Cuban economy, from the tightening of U.S. sanctions to internal problems such as non-compliance with investment plans, a drop in income from medical services, and a decrease in the production of Cuban goods for export such as sugar, among others.

As a result, the lack of foreign currency in the country has produced shortages in stores outside the regulated circuit due to the island’s dependence on importing raw materials and consumer goods. Long lines plague stores when the state provides them with a scarce product, which today is almost everything. This has made way for resellers, hoarders, and other purveyors of the informal economy. And what is not disputed is that the solution to this lies in increasing the productive forces in the country, in all of their forms, while also eliminating obstacles in order to increase the production of goods and services.

In 2019, given the evident shortage of products, foreign currency, and the exportation of capital by the private sector (in order to buy, in foreign markets, products lacking in Cuba to resell them domestically in the informal market), the country created a series of specialized stores that accept Freely Convertible Currency (or “MLC”). The stores began by selling electrical appliances at cheaper prices than on the black market. The physical dollar could be converted into a different bearer instrument that became the MLC.

There were similar good intentions behind authorizing Cuban nationals to import, in MLC, certain products that weren’t commercialized in the country. On March 11th, 2020, authorities opened the Office for Import Procedures and Accreditation for Clients of the CIMEX corporation, which days later incorporated the chain stores TRD and SASA.

With time, the MLC stores began to expand and had already begun to sell food and personal use products. The public questioned where they could acquire MLC in order to shop at those stores. In reality, unlike in the 1990s, the State was not selling it as a currency, and couldn’t because of the liquidity crisis it was experiencing.

The public questioned this supposed lack of foreign cash in the country, because for the past few months, large amounts of foreign currency had in fact been deposited in cash at the banks. Surprisingly, on June 10th, 2021, banking authorities announced that their vaults were full of dollars, but the U.S. Embargo prevented them from depositing them in external banks.

Judging by the lines at the banks and in stores, it was true that the population had deposited quite a lot of foreign cash in the banks. But could the banking system use that cash to sell MLC to the population in CADECAs and in the banks?

Some answered no because that cash has to be deposited from abroad into Cuban accounts. Only then can it be used for imports such as food, medicines, and other supplies in the fight against COVID-19, or for raw materials and supplies for production, and much more.

And it was true. But curiously, as of June 2021, it became impossible to make those deposits in Cuban banks because their vaults were full of USD. The banks would no longer accept any more USD in cash. It was also true that foreign banks refused to receive dollars from Cuba because of embargo sanctions.

If days before they had cancelled selling foreign currency at the airport because there wasn’t any “availability,” how does one understand such a measure? Realistically, that was not the fundamental reason why they could not take all the cash and sell it at the airport or at CADECA terminals.

It turns out that the cash the public had deposited in the banks was not for exchanging into CUP, but to be deposited in their own personal bank accounts. These funds are liabilities of the banks, which must respond to the clients that own them. Over time, customers could request that these funds be returned to them or expect to be able to use them to purchase products in stores at MLC. The latter option was most likely the cause of the increase in cash collection for MLC by Cuban banks.

When a product is purchased in an MLC store, the bank has to transfer MLC funds from the buyer’s account to the store’s account in USD. The accounts must have a sufficient balance in order to pay for the product it has sold and to acquire new products for the stores in MLC. For this reason, most foreign currency collected is moved abroad to bank accounts that make payments for products acquired by Cuban importers. Meanwhile, the profit in foreign currency that corresponds to these retail sales would be freely available to the stores, and ultimately, to their operators.

The banks know that not all the cash that is collected in a certain period of time is immediately spent. Nor is it demanded by clients to be returned to them. There is usually a surplus (except in times of uncertainty or dissolution of bank accounts) that can commonly be used by banks for their lending and other activities. But faced with a reality where the banks cannot access the market to sell pesos and buy foreign currency according to the specific needs of their clients, it is very important not to use all the cash that gets deposited. Otherwise, they will not be able to return money to their customers nor will the stores be able to buy new inventory to sell. Even if the stores have MLC balances in banks received from buyers’ MLC accounts, there would be no real support to pay for new products.

There are many contradictions surrounding the MLC store supply chain. Why are there not enough products in stores in MLC, despite the money deposited by the population in hopes of converting it into quality products and services? The cash in MLC is not “escaping” in CADECA sales, but is the State and its companies spending it on other purchases and investments that later result in the inability to meet the demands of the population?

The growth of unpaid debts to suppliers, and on the other hand the deposits in MLC, which cannot be returned in foreign currency “until the country has sufficient resources,” may provide indications of an inappropriate use of the money collected. If the money deposited by the population is used irresponsibly, the State will have to issue – once again – certificates and future payment commitments “until conditions allow.” Stores will not be able to restock properly, and the lines will continue, as well as the inability to meet demand.

Canceling the limited sales of foreign currency at the country’s airports draws attention to another aspect: does the cash in MLC exchanged at CADECAs and banks represent the only source for later being able to sell MLC to the population?

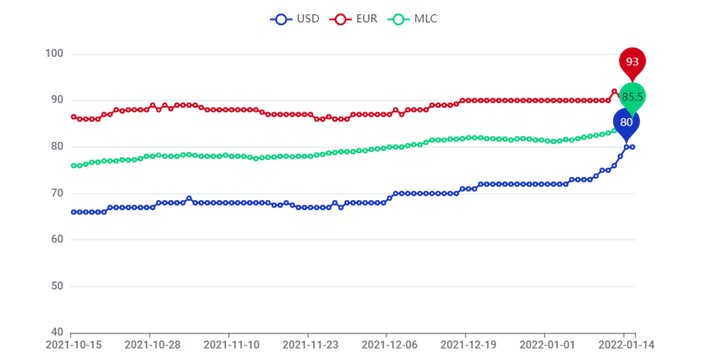

With an official exchange rate of 24:1, and another unofficial one that already exceeds 100 pesos for 1 USD and continues to rise, nobody will exchange foreign currency in the CADECA except for select tourists. Sources of foreign currency could also include: a money transfer from the exterior received by the beneficiary in Cuban pesos; extractions of Cuban pesos against foreign currency accounts held by foreign enterprises that reside in the country, domestic enterprises (with their liquid assets), and embassies.

Source: https://eltoque.com/tasas-de- Cambio-de-moneda-en-cuba-hoy

MLC is, in actuality, a bearer instrument since as of June 21, 2021, it’s not possible to deposit dollars in cash to the banks. But the peg for MLC accounts continue to be the U.S. dollar. MLC is not a new currency, it’s the amount of USD in a bank account. Yet MLC has developed a personality of its own in informal market operations.

Other questions would be: Where can the normal or salaried population with no connection to remittances or other sources acquire MLC for their needs? Do they have to do it in the informal market, which gets more speculative by the day? What was the wage reform of 2020 for if the informal exchange rate has led wages to lose the purchasing power that they thought they would have?

The parts of the population that don’t have connections to remittances or foreign currencies rely on buying MLC through account transfers. With such diverse realities, achieving the expected results of the tarea ordenamiento becomes complex. It takes a lot of initiative and desire to implement it, and despite the steps taken so far, the results show that it has been insufficient.

Solutions always exist. For example, previous to the tarea ordenamiento, there were stimulus funds in CUC for prioritized sectors of the economy that generated their own foreign currency. If this is done, it does not mean that the country will have issues in paying store chains because that MLC would come from bank accounts with real liquidity. This is not a proposition; this is proof that there always exist solutions to different problems.

Reestablishing international travel has allowed tourists and other travelers to arrive in Cuba with foreign currencies. But this does not seem to be enough because, with an informal exchange rate so different from official one, there’s a low expectation that they exchange that money through official channels.

We must break the vicious circle that has been created, where the unofficial exchange rate rises day by day. Among other reasons, this is happening because foreign currency is not officially being sold since the State does not want to sell it until it collects enough currency by exchanging it for MLC. But, at the same time, individuals do not exchange their currencies through official channels since they obtain a very unfavorable exchange rate compared to the unofficial rate.

Again, the issue is complex. The important thing should not have been to establish a generalized exchange rate of 24 CUP :1 USD on January 1, 2021, but to focus on how the value of the national currency would be managed from that moment on. If before the official exchange rate was 1 CUC :1 USD, and a CADECA exchange rate was 24 CUP :1 CUC, it is almost as complex now to have an official exchange rate of 24 CUP :1 USD and another “black market” exchange rate of 110 CUP :1 USD. There are large differences between one reality and the other, but similar problems arise, with the added difficulty that the CADECA exchange rate is controlled by the State, while the unofficial or “black market” rate is informal.

With the unofficial exchange rate moving further and further away from the official rate, the cure has ended up being worse than the disease. Currency unification and the disappearance of the CUC, together with systemic measures in the realm of currency circulation, have led to a lack of confidence in the Cuban financial and banking system. The decisions made by the Cuban government continue to aggravate the problems that have long plagued the CUP.

The result: growing inflation; the impossibility of acquiring basic goods and services with CUP; and sales for houses, cars, paintings, and other durable goods being quoted in dollars.

Meanwhile, time is showing that the buyers and intermediaries of dollars or euros are taking the currency out of the country, using it to finance their trips, or hoarding it for the future. This contributes to the devaluation of the national currency. Add to this the high salaries or incentives that a part of the state employees receives in CUP, but without assets to back it up, so they must acquire MLC.

In any case, one cannot forget that the margins for maneuvering the Cuban economy have been reduced even more. The embargo is intact, and COVID-19 continues to be an issue with new strains and mutations that force the country to spend resources on containing the virus. Comprehensive economic reform is increasingly necessary and urgent. Approving laws to encourage the creation of Cuban SMEs is not enough. There is still more space for liberalization, including in the direct importation of inputs.

Finally, is there nothing more to do? Will the embargo be around a while longer?

I believe that now is the time to put aside certain ideological precepts that some policymakers have which continue to slow down and hinder what Cubans are capable of. Socialist theory does not say that retail should be a State responsibility. And with that, I am referring to the private sector, where there are significant reserves for the creation of goods and services that stimulate the use of CUP.

The State, with its famous 63 measures, must achieve a certain level of efficiency for its companies, something that has yet to result in greater productivity. It is necessary to reanalyze price differences, some excessively so, such as the price of pork. A bad policy implemented within the agricultural sector has ruined the ability for the low-income sector of the population to obtain meat.

Competition and the market are essential at this difficult time. Those who oppose these suggestions should propose how to increase the supply of goods and services in this badly wounded and exhausted economy. Spare us speeches of roadblocks or revenge.

Three-digit inflation in the Cuban economy shows that key issues remain unresolved, such as the convertibility of the Cuban peso and price differentials within the informal exchange market. As the Cuban economist Pavel Vidal recently explained, “The most dangerous thing is that the economic authorities have been simultaneously promoting a partial dollarization with the use of the banking dollar (MLC), which casts doubts on the government’s confidence in the Cuban peso and its own monetary reform. Dollarization also tends to nullify the positive effects sought with devaluation and monetary reform.”

In summary, if offers of goods and services in CUP are not created in the short term, then the MLC will be here to stay for an indefinite period of time. Remittances will continue to play an essential role, as they do in any country in the third world, with the added complication that the country is financially blocked by the same country that issues the remittances.

Omar Everleny Pérez Villanueva has a doctorate in Economic Sciences from the University of Havana since 1998. He has a Master’s in Economics and International Politics from CIDE, AC Mexico, Federal District, since 1990. He has a degree in Economics from the University of Havana in 1984. Associate Professor. Former Director of the Center for the Study of the Cuban Economy of the University of Havana. He has given more than 300 conferences in different Cuban centers and abroad, highlighting those offered in various countries around the world. He has been visiting professor at Universities in the USA, Japan, Canada, and France and visiting scholar at the Federal Reserve Bank of Atlanta, Harvard University, Columbia University. He has published more than 100 articles in magazines and has co-authored several books, both in Cuba and abroad, highlighting those published with Harvard University, Columbia University, New York University, Sorbonne University, Paris 3, Institute of Developing Countries (IDE-JETRO) Japan, Complutense University of Madrid, and the University of Havana, among others.

llustration by Maikel Martínez Pupo. You can find him @MaikelStudio @maikelmartinezpupo.

BACK TO NUEVOS ESPACIOS