Tamarys L. Bahamonde

Cuba’s Economic Performance in 2021 and Opportunities for the Future

It’s difficult to succinctly encompass the complexity of the past few years. The economic crisis, accelerated by the COVID-19 pandemic, has had devastating effects on the global economy. Given this international situation, third world countries have been particularly affected. In Cuba’s case, the combination of external factors, an exhausted economic growth model, and the structural deformations of the national economy spurred one of the most aggressive crises the country has experienced. The economic crisis was initially classified as “conjunctural” by Cuban decision-makers, including President Miguel Díaz Canel, which delayed implementing policies to mitigate its effects. The crisis, although exacerbated by external events, is profoundly structural, and I would add chronic. From a political and social point of view, this is the second crisis of significant magnitude to affect the country in less than 30 years.

One of the most important things to consider when analyzing the economic performance of the last two years is the international context. We were forced to basically “turn off” the world economy for an unprecedented amount of time. Restarting and returning to its pre-pandemic state will take time. Additionally, the pandemic has not been controlled homogeneously on a global scale, vaccination rates and access to immunization are unequal, and the probability that new vaccine-resistant variants will appear can delay economic recovery.

Economic performance and policy design

External factors preceded and combined with internal distortions to aggravate the crisis in 2020 and 2021. Internally, the prevalence of a dual monetary and exchange rate, a strangled, national production system, a state monopoly on foreign trade, and limited opportunities for investment in the national or cooperative private sector compounded the initial impact of the crisis. The tarea ordenamiento (T.O.) announced in December 2020 promised changes to the structure of the economy like financial consolidation, starting with the elimination of the CUC and the dual monetary system. The results of this policy a year after its announcement will be discussed later.

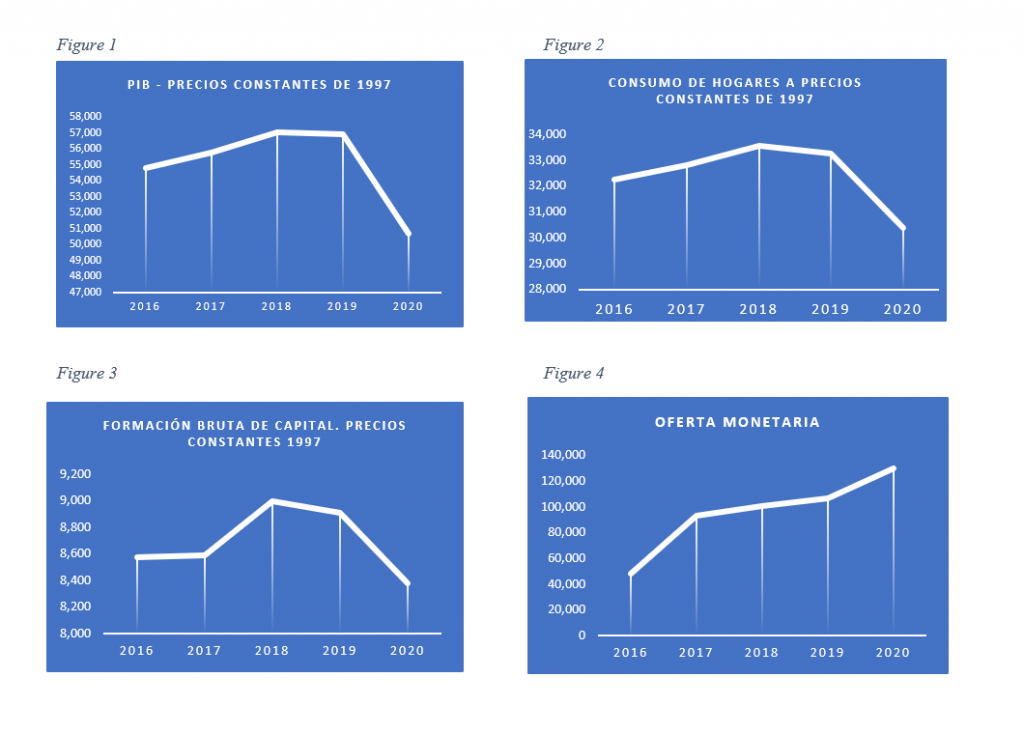

2020 was a poor performance year in many areas of the Cuban economy. I am not going to spend much time on 2020, only what is necessary to understand that 2021 was the result of a prolonged, multi-causal regressive process. Figures 1 to 4 show the drop in selected indicators in 2020, although it started before the pandemic. Since 2019, Cuba has registered declines in indicators such as GDP, household consumption, and gross capital formation. These indicators had been slowing down since 2017. There are at least two causes that precede COVID-19 paralyzing the global economy: the economic and political crisis in Venezuela, which affected the supply of fuel to Cuba, and the Trump administration in the White House, which introduced multiple sanctions on Cuba, halted consular services in the country, and reduced the number of flights from the United States to the island—a direct impact on tourism. The performance in 2020 shows that the accumulation and convergence of external elements, the COVID-19 crisis, and the unresolved, structural deformations of the Cuban economy led to a 12.3% drop in GDP that year.

Public statistics from 2021 reveal increases in several productive and investment indicators compared to the same period the previous year. However, we must be careful of the mirage these numbers can create. Any comparison between 2021 data and 2020 data during the same time period will be inaccurate. Future analyses should include both inflation and the change in the official exchange rate as of January 2021. In short, 2021 and 2020 are not absolutely comparable. However, we can refer to some data at our disposal that is worth mentioning.

During the ordinary session of the National Assembly of Popular Power (ANPP) in October 2021, the Deputy Prime Minister and Minister of Economy and Planning, Alejandro Gil Fernández, summarized the country’s economic performance to date. From the data offered, it is worth drawing attention to the 5,312 contracts that had been signed for foreign trade operations. 197 were for exports and 5,115 for imports. In his report to the ANPP, Marino Murillo stressed that, of the 7 billion pesos in recorded losses, 82% is concentrated in the agricultural sector—a worrying fact that partially explains the grave food situation. As expected, the devaluation of the peso and the elimination of the dual exchange rate in the Cuban business sector has positive and negative impacts. On the one hand, it contributes to financial improvement by providing greater transparency to corporate financial operations. On the other hand, it affects companies that previously operated on profit margins and will now operate at a loss. The fate of those that end 2021 in the red is pending. They can either merge with others or close permanently. In either case, it will imply that a significant number of workers will become unemployed. Creating jobs for the unemployed must be a top policy priority. A group of laws that were approved to facilitate and expand private economic activities and national cooperatives were an important step in that direction. But we will see later that the private and cooperative sectors are limited when trying to solve these problems in the short-term.

According to data offered by Alejandro Gil during the II Cuba Business Forum 2021, Cuba was able to halt the sustained decrease in GDP from the previous two years. This does not mean that it is growing, it indicates that the fall has stopped for a period. The minister offered essential data on micro, small, and medium-sized enterprises (MSMEs) and the self-employed. At the end of November 2021, 602,415 Cubans were registered as self-employed workers. Women only represent 35% of that total, which could indicate a persistent gender imbalance in access to better income and capital to invest. Up to December, more than 901 MSMEs had been created in the country—865 of them private—and 406 of them non-agricultural cooperatives. MSMEs have concentrated on activities related to manufacturing and food production. It is estimated that they have generated more than 11,000 new jobs. The latter is crucial for what the state sector could face.

Despite this relatively encouraging scenario, other aspects loom over private MSMEs and cooperatives. The newly created MSMEs and cooperatives are startups that need to overcome difficulties inherent to the launch of new ventures, plus the obstacles in supplying and the distortions in the monetary system particular to Cuba. The elimination of the dual exchange and monetary system is relative in the national economic context. Despite eliminating the circulation of the CUC, the MLC has functioned as a second currency and is essential for making purchases in the country´s retail stores and for acquiring basic products. This imposes new challenges for citizens and entrepreneurs alike. The recent authorization to request credits in MLC could alleviate the financial tension that this monetary duality causes. However, the legislation requires paying back these MLC credits within 120 days. Four months may not be enough time for MSMEs or cooperatives to guarantee repayment of these credits in MLC.

Additionally, the inability of the Cuban government to sell foreign currency has raised the price of MLC in the informal market, the only place where they can be bought. On December 11, El Toque reported the informal exchange rate for the sale of foreign currency at 89 CUP per euro, 70 cup per dollar, and 80.50 CUP per MLC, with a prevailing upward trend. Inflation has undoubtedly been one of the most visible negative impacts of the tarea ordenamiento until now. Official reports calculate it at 222% in state entities, and at 6900%[1] in the informal sector, although other calculations place it at over 500%. This inflationary process has exceeded the average wage increase of 6.75 times in the state sector of the economy; it has significantly reduced the purchasing power of the national currency; and it has undermined the role of the Cuban peso in the economy when confidence in the Cuban peso was expected to be restored. Undoubtedly, the persistent use of MLC undermines this last objective, no matter how justified the reasons offered to explain their permanence in the national economy may seem.

There are several factors to consider about the crisis in general and inflation in particular. The Cuban economic crisis began before the COVID-19 pandemic and worsened as a result of it. It was not until it became clear that the crisis was not conjunctural that structural policies were outlined and announced in December 2020, what we know today as the tarea ordenamiento. The group of policies, which trickled in through the year 2021 in a fragmented and gradual way, had two complications: the timing of when they were introduced and the order. First, they are necessary policies that should have been implemented years ago. In fact, many of them were approved in the Economic and Social Policy Guidelines during the VI Congress of the PCC in 2011, but an international pandemic crisis was necessary for Cuba to decide it was time to introduce the policy of adjustments designed and approved a decade ago.

Additionally, economists warned that both the monetary devaluation and the exchange and monetary unification should be preceded by a group of policies that would stimulate production and decentralize important economic decisions. Part of the proposals included granting legal status to MSMEs and broadening and expanding the opportunities for the creation of national private companies and domestic cooperatives. One of the objectives would be to absorb part of the labor force that the Cuban state could not, and another is that they would function as a productive complement to the state sector of the economy. Implementing these measures months after the monetary reform began, during a deep economic crisis and galloping inflation, left little possibilities for these forms of management to cover those gaps. Additionally, most of the MSMEs created until 2020 were integrated into the tourism sector, the sector most affected by the international crisis and the policies drawn up by Washington towards Cuba during the Trump administration and supported by Biden.

Opportunities and obstacles

Despite the complexities of the national and international contexts, and the negative effects of the adjustments in Cuba, the laws approved in 2021 open up new opportunities for the national economy. As a warning, it is worth clarifying that the results will not be seen immediately. The policies introduced in 2021 will have results in the medium and long term. Unquestionably, expanding the activities in which one can invest in the domestic private sector, granting legal personality to private MSMEs, and allowing them to carry out foreign trade operations, as well as access credits in MLC, should give impetus to many existing projects as well as new ones. Although this is good news for the cooperative and private business sector, we must recognize that many of the difficulties within Cuban public policies lie in their implementation. Beyond the traditional setbacks that MSMEs face in terms of positioning, hiring, taking off, and efficiency, there are many factors that do not depend on the companies and have to do with the environment. In addition to the aggressive national and international contexts, for example, attention must be paid to the performance of state companies in charge of processing import/export operations for private companies and cooperatives. Any failure in the processes can delay supplies and interrupt the production of goods or services for MSMEs that do not have the financial conditions to face delays.

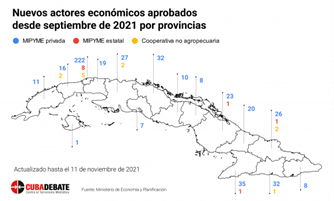

The initial policy steps that have been taken in the administrative and fiscal decentralization of the territories on the island should be recognized. As part of this policy, Local Development Projects (PDLs) can play a decisive role in reducing persistent territorial inequities. A substantial portion of economic activity continues to be concentrated in Havana. According to ONEI data, the volume of investments in the capital has been more than 50% of the total from 2016 to 2020. In 2020, it reached 57.9%. In the first semester of 2021, Havana had 66% of the total investments executed. Official data shows the unequal number of new economic actors approved territorially (See Figure 5). The opportunity, however, lies in how the provincial governments manage the distribution of some subsidies or incentives that help reduce the gap. As a general rule, urban areas accumulate more experience managing territorial development projects. Rural areas tend to be more limited in the types of activities they can carry out. The PDLs, if they are taken full advantage of in their implementation, can contribute to changing this reality in the medium and long term, exploiting new or traditional potentialities in the regions.

Figure 5

I have referred to the potential impact on state companies. Approximately 500 state-owned companies closed at a loss in the first trimester of 2021. This can and will have an impact on the Cuban labor market. We do not yet know what will happen to these companies. Some can merge and others will disappear. In any of the possible scenarios, we must contemplate the danger of an increase in unemployment. The recently approved local development projects and the recently revised law on small and medium enterprises may offer alternatives to absorb part of these workers. This leads to another group of concerns with the relatively reduced role of the state as the exclusive employer in the economy. The protective role of unions in Cuba must be recovered, as well as establishing mechanisms that guarantee that Cuban labor legislation is respected and the rights of workers protected.

In short, it is difficult to attract investment in a context of global economic and financial crisis. Cuba’s economic performance today and in the near future is in the hands of the limited endogenous capacities of the country, the political will of its leaders, and the possibilities of its citizens to boost the economy—a task that is not impossible, but difficult and full of setbacks.

Tamarys L. Bahamonde has a degree in Economics and a Master’s in Regional Development. She was an economics professor at the University of Havana and has published articles and given presentations within the field, with an emphasis on the business cycle, labor market, and decision-making branches. She has been linked to both the state and private sectors on the island. She graduated in 2018 from the Certificate in Nonprofit Management and Voluntary Action from the University of Delaware as part of the Fellowship Award for 2017-2018 Academic Year- Nonprofit Management Scholarship Program for Cuban Citizens (IREX). Since September 2018 she has been working on a Ph.D. in Urban Affairs & Public Policy from the University of Delaware where she is also an Independent Public Policy 110 Instructor.

Illustration by Maikel Martínez Pupo. You can find him @MaikelStudio @maikelmartinezpupo.

[1] Experts on the subject disagree on the accuracy of this calculation of inflation.

BACK TO NUEVOS ESPACIOS